The contest among cities in 2023 is entering its final stretch.

The economic data for the first three quarters is uneventful yet deeply significant.

The prestigious 1-trillion-yuan GDP club is set to welcome new members, with some cities striving towards the 2-trillion-yuan mark.

While racing each other, cities that previously experienced a slowdown in growth are feeling the pressure, which hints at profound underlying reasons and strategic breakouts.

01 The forest of little industrial giants

In September this year, Huawei's release of Mate 60 marked its resurgence in the high-end smartphone market, hailed by American experts as a symbolic event of China's technological breakthrough against blockades.

The past few years have not been easy for Huawei for a variety of reasons. Despite challenges, Huawei has not only survived but also achieved significant technological advancements.

Mate 60, produced in Dongguan's Songshan Lake, has sparked both widespread acclaim and panic buying.

With respect to consumer electronic products, beyond component parameters and manufacturing processes, innovation lies in the execution of these design drawings instead of the drawings themselves.

Breakthroughs are underpinned by Dongguan's robust supply chain system and manufacturing excellence.

This represents a shift for Chinese companies like Huawei from utilizing top-tier supply chain solutions to co-creating them.

Significantly, Dongguan is not just the final production site for Mate 60, but also houses key suppliers in Huawei's supply chain.

Similarly, Dongguan faces immense pressure this year. Data shows that its GDP grew by 2.0% year-on-year to 811.872 billion yuan in the first three quarters.

Despite complex economic conditions both at home and abroad, the city's industrial investment in the first three quarters grew by 5.7% year-on-year, 5.3% higher than that of the first half year and driving an overall increase of 2.3% in fixed asset investment.

The latest data shows that Dongguan's foreign trade reached 102.9 billion yuan in October, representing a 5.3% increase year-on-year and ranking second in Guangdong Province. This signifies a stabilizing and rebounding trend.

Dongguan Port

Many cities are closely watching Dongguan, not just as a global manufacturing hub but also for its acute sensitivity to global markets. Dongguan's journey from basic contract manufacturing to trying enterprise transformation and innovative development offers valuable insights for businesses and the entire manufacturing industry of China. With traditional advantages like low land and labor costs diminishing, Dongguan's answer lies in its supply chain.

Here in Dongguan, the supply chain supports not only component supply and assembly, but also technological breakthroughs and innovations, as well as enterprise transformation and upgrading.

In electronics, end products always play a key role in driving industry innovation. Improvements in processes, cost optimization, and yield enhancement all require long-term collaboration and negotiation between suppliers and brands.

In summary, Mate 60 is just the tip of the iceberg, representing collective breakout efforts of each node and supplier in the supply chain. If Huawei is an industrial giant, then its suppliers are “little giants”, making Dongguan a forest of these “little giant” companies.

Currently, Dongguan is home to 210,000 industrial enterprises, including over 13,000 enterprises above designated size and more than 9,000 high-tech enterprises recognized nationally. In addition, the city boasts an industrial cluster worth a trillion yuan and four clusters each worth a hundred billion yuan. Such solid manufacturing foundation forms the cornerstone of Dongguan's high-quality economic development.

Modern supply chains are not mere linear systems; they resemble a network, akin to a rainforest with interwoven vines.

The flourishing enterprises, especially the “little giants”, the robust supply chains, and the innovative ecosystem, have opened up new possibilities to Dongguan.

In the past three years, China’s new energy vehicle industry has seen explosive growth. Cities like Changzhou and Yibin have attracted chain leaders through investment promotion, creating a clustering effect. Power battery companies, serving as chain leaders, have fostered significant supplier networks and manufacturing hubs, furthering this effect.

Dongguan's presence in the spectacular new energy industrial chain was initially unnoticed, but it swiftly advanced to the forefront.

Dongguan's journey from zero to one in the new energy sector offers another strategy for urban industrial rise: leveraging its strong industrial base, comprehensive sectors, resilience, technological transfer capabilities of “little giant” companies, and vast supply chain advantages to steadily enter and establish a foothold in emerging industries.

Dongguan Chitwing Technology Co., Ltd. (“Chitwing”), a Dongguan-based company, specializes in research, development and production of precision structural components, holding a significant position in the consumer electronics supply chain. Its clients range from domestic smartphone giants to chain leaders in Silicon Valley. Starting as an OEM, now Chitwing has not only become a vital behind-the-scenes player for electronics industry leaders, but also impressively transitioned its core technologies to the new energy sector. Doesn’t that sound magical at all?

Dongguan Churod Electronics Co., Ltd. (“Churod”), initially a contract manufacturer for home appliance components, now plays a crucial role in the photovoltaic and new energy vehicle supply chains with its products ranging from relays, low-voltage electrical appliances, to high-precision non-standard automation equipment.

Guangdong Topstar Technology Co., Ltd. (“Topstar”), which began with auxiliary equipment for injection molding machines, now excels in industrial robots and CNC machine tools, and seamlessly integrates into the new energy sector, providing green energy solutions for smart factories.

These transformations raise a key question: how did such remarkable metamorphoses occur?

02 The making of supply chain wizards

Chitwing was founded in Chang’an Town and Topstar in Dalingshan Town, both established in 2007; Churod was founded in Tangxia Town in 2009. These are meaningful dates, marking a pivotal era for Dongguan.

The 2008 global financial crisis posed a severe challenge to Dongguan, but it also marked the beginning of the city's transformation.

The establishment of these three companies around 2008 is not coincidental but reflects Dongguan’s and its enterprises’ adaptive and timely response to changing times.

Since the 1980s, Dongguan began accommodating traditional manufacturing industries from Hong Kong, like textiles, footwear, bags and toys production, gradually integrating into the global supply chain system.

A supply chain revolves around a core company and includes suppliers, manufacturers, transporters, distributors, retailers, and customers, forming a chain-structured network.

In simpler terms, a supply chain is a link connecting suppliers to customers. Through this chain, companies transform raw materials into products and sell them to customers, thus generating economic benefits.

In the early 1990s, with the aggressive entry of IT manufacturers from Taiwan, Japan and South Korea, Dongguan gradually developed an export-oriented economy based on contract manufacturing. As the number of enterprises increased and industries diversified in Dongguan, they evolved from isolated suppliers and simple contract manufacturers to becoming vital nodes in numerous supply chains.

The 2008 financial crisis was a wake-up call for Dongguan, signaling that the days of simple production for profit were over. The city recognized the need to expand into full-process manufacturing, transforming its supply chains from a linear chain structure into a crisscrossed network like a rainforest.

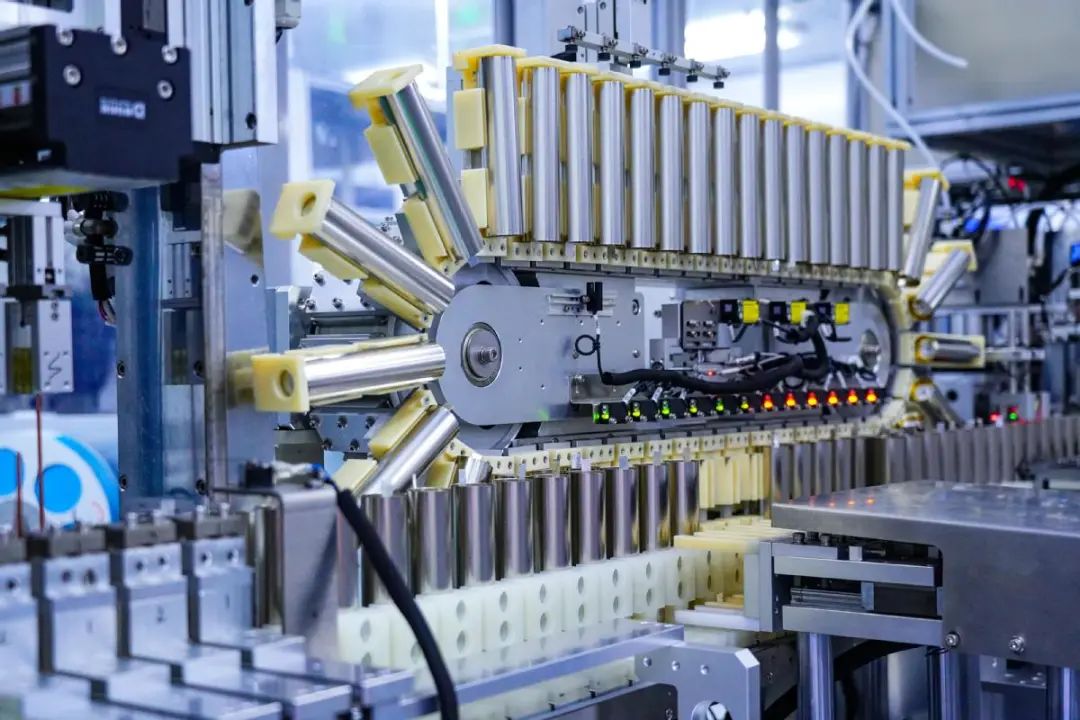

This evolution from a linear chain to a network, from a structure to a system, and from a single tree to a rainforest, infused the supply chain with vitality and innovation capacity. Stepping into Topstar's production workshop, one can't help but be captivated by the variety of robots - their arm movements in assembling products are as flexible and fluid as human limbs.

In its early stage, Topstar focused on auxiliary equipment for injection molding machine, a key device for shaping plastic into various forms using molds.

From the perspective of a supply chain, Topstar was merely a regular supplier, neither irreplaceable nor high-tech. However, interactions with customers led Topstar to realize the increasing necessity of robotic arms in injection molding.

In order to address the high costs and maintenance challenges of imported robotic arms, Topstar embarked on developing its own. By 2011, Topstar had successfully developed a controller significantly reducing the production cost of robotic arms. In 2012, Topstar expanded its portfolio to include central feeding systems, in line with new demands in the injection molding field, thus establishing a complete range of products and solutions centered around injection molding applications. This marked the beginning of the company’s venture into automation.

During the expansion of its automation business, Topstar identified a need for multi-joint robots with greater degree of freedom for more diverse automation scenarios. Consequently in 2015, the company began developing multi-joint robots. Now Topstar’s industrial robot products mainly include SCARA robots, six-axis multi-joint robots, Delta parallel robots, and collaborative robots, which are extensively used in sectors like 3C, packaging, new energy, auto parts manufacturing, 5G, photoelectric, and household appliances.

It might seem like Topstar’s growth and diversification were effortless, but reflecting back to its founding in 2007, one wonders if the company had been content with its position in the supply chain and indifferent to innovation, would its current story exist?

From its origins in injection molding auxiliary equipment to branching into industrial robots and then entering the machine tool industry, Topstar’s continuous ascent along the supply chain epitomizes the evolution of Chinese manufacturing.

Guangdong Dtech Technology Co., Ltd. (“Dtech”) shares a similar journey.

Dtech is a high-tech enterprise mainly engaged in research, development, production and sales of micro drills, milling cutters, precision tools, intelligent equipment, industrial films and grinding wheels. The company holds a 19% market share in the drill bit business, ranking first globally.

Drill bits, highly precise industrial manufacturing tools, are used for drilling holes in circuit boards.

Rewinding to 1997, Dtech was primarily a trading company and not even a newcomer to OEM, importing foreign cutting tools for domestic sales.

Despite its trading origins, Dtech harbored greater ambitions. The founder’s obsession with core technology drove the desire to rise above being a mere trading intermediary. In-house development offered clear benefits — long-term cost savings on imports and a stronger voice in the value chain.

Starting from selling imported cutting tools to manufacturing their own drill bits and milling cutters, Dtech then realized the necessity of equipment for making these industrial tools. This led them to develop equipment for tool-making. After discovering that the technology for key equipment components lay with Swiss companies, the company focused on mastering this core technology.

Its perseverance paid off. Dtech now produces drill bits with precision up to 0.05 millimeters, the thickness of a human hair. Benefiting from the wide downstream applications of PCBs, the company’s future applications can extend from 3C to aerospace and automotive sectors.

Dtech’s drill products

This phenomenon unveils a trend in modern industry — when companies climb up the supply chain due to foresight, steadfast commitment to technology, and timely response to market demands, they gradually develop the capability to transition into cutting-edge technologies and emerging industries. This capability, in turn, facilitates their entry into the forefront of technological and industrial innovation.

In 2007, Chitwing began with plastic parts (i.e. mold manufacturing). As mold production became more sophisticated, the company started developing and manufacturing structural components for mobile phones, shifting its client base from brands like Ningbo Bird to OPPO, Huawei and Google.

This evolution seemed natural until Chitwing recently ventured into the new energy sector, demonstrating strong confidence. A similar trajectory is observed with Churod. In 2009, Churod mainly manufactured relays for the home appliance industry, serving clients like Midea and Gree. Now the company has expanded its clientele to include corporate giants in the 5G and new energy sectors.

Transitioning from the consumer electronics and home appliance industries to the new energy sector might seem unrelated at first glance. However, a visit to the factories of Chitwing and Churod reveals the underlying connection.

As smartphones become smaller and more sophisticated, demanding higher heat dissipation, a significant part of Chiwing’s business involves manufacturing structural components for phone backplates. Similarly, energy storage devices in new energy vehicles require efficient heat dissipation solutions, employing fundamentally similar technology.

Churod started by developing temperature control systems for air conditioners, which regulate temperature through voltage changes. Today, whether it’s 5G base stations or new energy charging piles, voltage regulation is integral, albeit with higher voltage requirements — ultimately, it’s all about energy conversion.

This challenging yet correct path leads to a convergence of goals and solutions.

In Dongguan, many such enterprises are strengthening the foundation of the city’s manufacturing industry, enriching the innovation ecosystem, and offering new possibilities for supply chains. The evolutionary ascent of supply chains are dynamic, endowing them with the capacity to evolve and adapt.

03 The future of supply chains lies beyond the chains themselves

Businesses often unanimously acknowledge the advantages of Dongguan’s supply chains.

Some companies have moved part of their production lines to the Yangtze River Delta and Central China, while others have ventured overseas, establishing branches in Vietnam and Thailand. Through comparison, the superiority of Dongguan’s supply chains becomes even more apparent.

The most evident advantage of Dongguan’s supply chain is its low response cost. The vast majority of components required for production can be sourced within a two-hour drive. Chitwing notes that in Dongguan, a new product can go from design drawing to prototype in just 18 days.

This efficiency is underpinned by Dongguan’s strategic location in the prime area of the Guangdong-Hong Kong-Macao Greater Bay Area (“the Greater Bay Area”), offering convenient transportation and proximity to major cities like Hong Kong, Guangzhou and Shenzhen, thus providing businesses with fast and efficient logistics channels.

Topstar points out that Dongguan, as a crucial manufacturing base in China, boasts complete industrial clusters, including electronics, home appliances, textiles, building materials, etc. This allows enterprises to achieve a synergistic effect within the supply chain, reducing production costs.

Besides cost reduction, these industrial clusters also aid in technological breakthroughs.

An industrial park in Nancheng Sub-district

Today’s factories in Dongguan are not just bleak assembly lines but are more akin to geeky industrial parks where an engineering culture is quietly taking root and flourishing.

In Dongguan, supporting upstream and downstream enterprises in the supply chain often neighbor the chain leaders, making technical collaboration and problem-solving more accessible.

Employees can easily seek advice from engineers in adjacent factories over a coffee, as they are just next door.

Being in the Greater Bay Area, close to international markets, many Dongguan enterprises have grown stronger through global engagement. Chitwing candidly shares that dealing with demanding European and American clients in the early years forced the company to continuously meet customer needs. Gradually, Chitwing began anticipating and understanding client requirements, eventually offering consulting and comprehensive solutions to international clients.

This transition from solving small client issues to providing complete strategic blueprints signifies a profound transformation.

International clients sometimes also enhance a company’s acumen. Churod ventured into the new energy sector quite early, at a time when new energy was hardly mentioned domestically. The company’s foresight stemmed from a collaboration with Emerson, who had recognized the potential of this industry-changing sector through a new energy project in Europe.

At this point in the story, Dongguan, originally a supply chain powerhouse, has in fact transcended the confines of supply chains.

American urbanologist Lewis Mumford famously stated, “The hope of a city lies outside the city,” referring to the importance of inter-city collaboration for the development of individual cities.

Similarly, the future of supply chains lies beyond the chains themselves.

In a sense, Dongguan’s efforts in climbing the supply chain ladder have transcended the traditional concept of supply chains, entering the realm of industrial chains.

As previously discussed, a supply chain is centered around a core company, encompassing the production of components, intermediate products, final products, and the distribution network that delivers these products to consumers. In contrast, the industrial chain is a concept containing four dimensions: value chain, enterprise chain, supply and demand chain, and spatial chain.

The China-Europe Railway Express (Changping, Dongguan) loaded with new energy vehicles is ready to depart.

Take the example of new energy vehicles. From a hardware perspective, they comprise batteries, motors, drive shafts, tires, brakes, windows, seats, lights, and more. From a software perspective, they include control systems, automotive services, and insurance. All these components fall into different industries, and the logical and spatial layout relationships formed by the industries associated with the production of new energy vehicles constitute the industrial chain.

To put it more vividly, Zhengzhou is an undisputed hub in Apple’s supply chain, but the absolute domination of its industry chain lies in California, USA.

Globally, manufacturing powerhouses like the United States, Germany and Japan are few. Each of these nations has its unique approach to manufacturing.

Dongguan, known as the world’s factory, encapsulates a microcosm of these countries’ manufacturing prowess and contributes its innovative solutions.

The overall ecosystem of Dongguan’s manufacturing sector closely resembles that of Germany.

Beyond the craftsmanship spirit, Germany’s manufacturing strength lies in the diversity of its industrial ecosystem. This ecosystem is shaped by timely government policies and the pivotal role of countless enterprises.

German manufacturing is akin to a deep forest, where large corporations are like towering trees and, micro, small and medium-sized enterprises (MSMEs) are the underbrush and moss, together forming a complete industrial ecosystem.

These MSMEs, often underestimated, specialize in niche sectors, giving rise to numerous globally influential “hidden champions”.

If the quantity of leading companies and the completeness of the industrial chain represent a city’s existing strength, then the number of specialized and sophisticated enterprises with core technologies, such as the “hidden champions” and “little giants”, in the industrial chain is a crucial indicator of a city’s potential for future development.

In July, the Ministry of Industry and Information Technology announced the fifth batch of national-level specialized and sophisticated “little giant” firms. Dongguan had 81 companies on the list, ranking third in Guangdong Province and first among prefecture-level cities, alongside Shenzhen and Guangzhou, making it a hub for these “little giants”. These enterprises may be small in size, but their defining feature is perfecting a product or mastering a technology, demonstrably enhancing a city’s manufacturing competitiveness.

Statistics show that over 90% of Dongguan’s specialized and sophisticated enterprises are in the manufacturing sector. Over 70% have been deeply engaged in their subsectors for more than a decade, leading the market share of their principal products, with more than 50% of these companies dominating over 40% market share in their respective niches.

A production workshop of a new energy vehicle company in Dongguan

The ascent of Dongguan’s manufacturing sector also mirrors aspects of Japan’s industry.

Currently, Japanese manufacturing is characterized by a shrinking footprint, structural optimization, and quality enhancement. The retreat of Japanese brands like Toshiba, Sony and Sharp from the Chinese market in the past decade has been seen as evidence of “Japan’s disappearance”.

For instance, after Toshiba completely withdrew from consumer electronics, it ventured into large-scale nuclear power, new energy, and hydrogen fuel cell power stations. Toshiba’s core business now lies in global heavy industry operations and technologies in nuclear power, new energy, and hydrogen fuel cells. This iteration of Toshiba may not be as well-known or as large as before, but it has a more robust foundation in heavy industrial technology.

Disappearing in the front-end market and gaining a firm foothold in the upstream market, Toshiba has achieved successful transformation, which almost epitomizes the transformation and upgrading of the Japanese economy.

Like Toshiba, Dtech has climbed upstream, focusing on core technology breakthroughs.

In contrast to Germany and Japan, the U.S. manufacturing sector is more hollowed out. Yet it still commands the top of the value chain, thanks to super-chain leaders like Apple and Boeing.

Similarly, Dongguan’s Songshan Lake is home to super-chain leaders like Huawei.

In recent years, Huawei’s breakthroughs in the mobile phone industry and its continuous empowerment of the entire manufacturing sector have not ceased.

Huawei focuses on understanding different industrial chain characteristics rather than just single-point breakthroughs, aiming for a smooth and secure supply chain system.

This new model of full-chain industrial empowerment requires both a keen sense of cutting-edge technology and control over its implementation. A company’s true ecological competitive advantage always benefits from the progress of the entire industrial chain.

Looking ahead, Dongguan needs more chain leaders across various industrial chains.

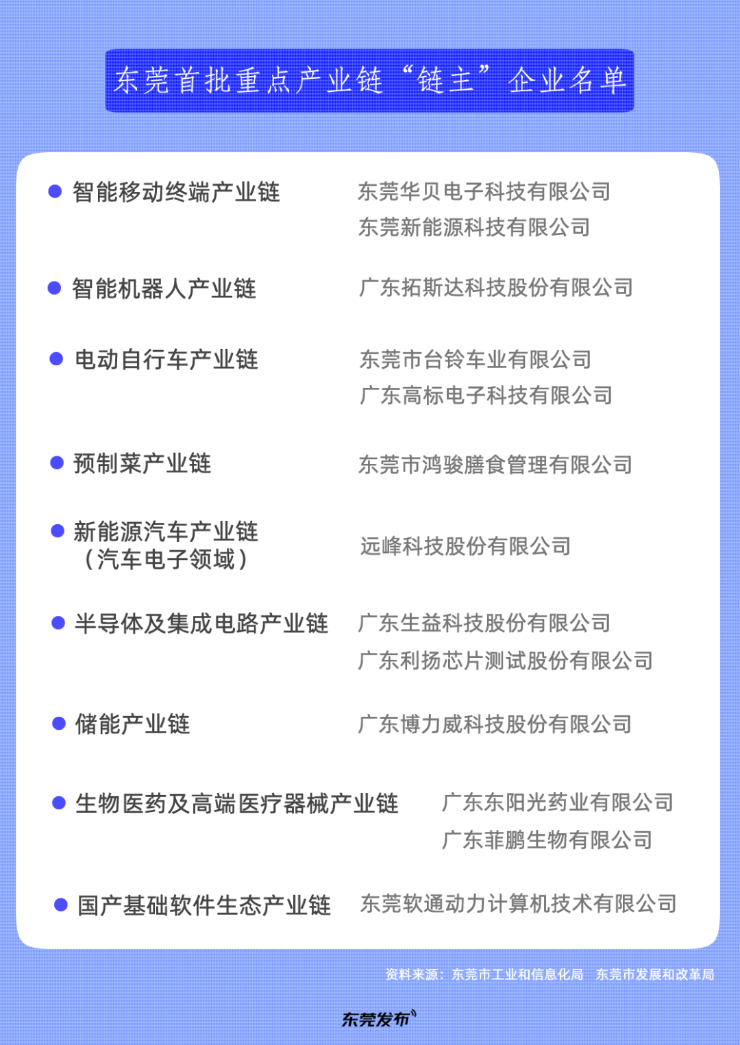

Since the beginning of this year, Dongguan has identified 9 key industrial chains and 13 “chain leader” companies, supporting them and the development of their industrial chains so as to enhance autonomy, flexibility, risk resistance, and sustainability of these industrial chains and even the whole economy.

Dongguan is also making its unique breakthroughs.

The “technology transfer” of companies like Chitwing, transitioning from Dongguan’s forte in electronics to high-end equipment manufacturing, exemplifies deep industrialization.

The rapid rise of Dongguan’s new energy sector from scratch also stands as proof of this.

04 Conclusion

The stories of these enterprises and the story of Dongguan, are also a tale with distinct Chinese characteristics.

In Dongguan, innovation stems from enterprises and market forces. However, the rise of Songshan Lake and the initiation of the new energy industry also involves government support. The fusion of these elements forms a benchmark in the advancement of China’s manufacturing industry.

Many people may still perceive Dongguan’s manufacturing with an outdated stereotype, associating it only with labor-intensive industries. But in Songshan Lake, the future Xiegang Town, and increasingly across Dongguan, the picture is changing.

More and more factories are adopting full automation to minimize errors, with few workers seen in the workshops. At some critical positions, workers mainly operate computer software. At factory gates, traditional groceries have been replaced by chain convenience stores, accompanied by sports facilities, with more people enjoying coffee. Their faces reflect the future of the city.

The completion of a city’s innovation system requires persistent exploration and the participation of the entire industrial chain. It is a prolonged journey.

Dongguan, with determination and aspiration, continues to pursue this path.